Major Developments:

Mayor Adams proposes Manhattan rezoning of Midtown to allow conversions of offices to residential construction in areas that only permit manufacturing and office use. West 23rd to West 41st streets is zoned for manufacturing, which prevents ground-up residential development and conversions of vacant office space for residential use. Office conversions could lead to 20,000 new apartments but would require changes to the Multiple Dwelling Law, including lifting the cap on the city’s residential floor area ratio.Citadel is eyeing a 51-story, Norman Foster-deleased tower at 350 Park Avenue, where it will redevelop properties leased from Vornado Realty Trust and Rudin Management. Citadel would occupy about 54% of the 1.7 million-square-foot building, which would rise to 1,350 feet. Initial proposals say the building is expected to be completed in 2032.

Murdoch is in talks to sell Move Inc, the parent of Realtor.com, to CoStar: $3B deal would go further to CoStar Group. The move would further entrench CoStar in the residential space, following major acquisitions such as Apartments.com and HomeSnap.

The New York Gaming Facility Board has issued a request for applications to issue up to three commercial casino licenses in and around New York City. The minimum investment and license fee seeking to build a commercial casino is $500 million each, an applicant can propose a higher license fee. The application fee is $1 million with no deadlines for the remaining three licenses. The state already awarded four destination resort casinos in upstate New York after the state’s constitution was amended in 2013.

- SL Green Realty and Caesars Entertainment Roc Nation are seeking a gaming license in Times Square.

- Hudson’s Bay Company announced its bid to turn the top three floors at 611 5th Avenue into a casino. The Saks project, starting on the store’s ninth floor, would span 200,000 square feet, with a lobby and separate casino entrance.

- Related and Wynn Resorts, a downstate casino license at Western Yards, directly next to the Javits Center convention venue, at Hudson Yards, is the largest U.S. private development.

- Steven Cohen is eyeing a casino license in Queens near Citi Field.

- Stefan Soloviev is interested in applying for a license to operate a casino just south of the United Nations in Manhattan.

- Thor Equities unveiled a $3 billion-plus casino, hotel and entertainment proposal for New York’s Coney Island.

Municipalities with MTA rail stations would be required to rezone areas within half a mile of the stop, allowing for at least 25 homes per acre. The proposal includes $250 million for infrastructure to accommodate increases in density and an expedited environmental review process for the rezonings.

Adams announces plan to convert 20,000 units with Eased zoning restrictions, tax breaks part of mayor’s blueprint to bring 20,000 new units online in the next decade through conversions. The plan calls for the easing of zoning restrictions and tax breaks for property owners to get projects going. Adams’ plan calls for a variety of housing types for conversions, including supportive housing, across areas in Midtown Manhattan and downtown Flushing in Queens.

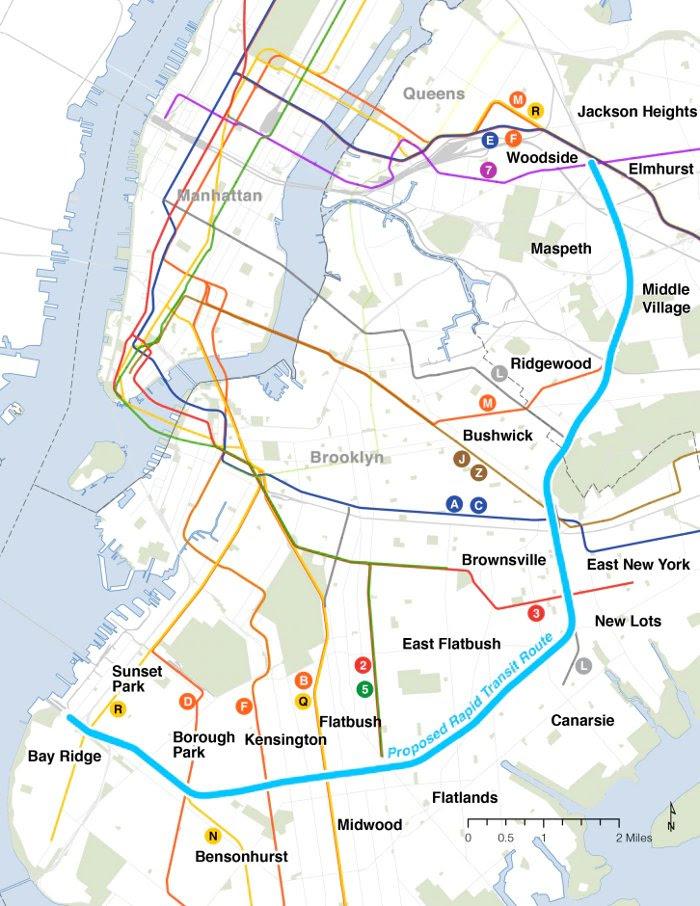

Governor Hochul announced she plans to move forward with the light rail Interborough Express (IBX), connecting Brooklyn and Queens through the existing and underutilized freight rail that runs from Sunset Park to Jackson Heights. The IBX would connect up to 17 different subway lines, as well as the Long Island Railroad. The Governor plans to work with the MTA over the coming months to complete the environmental review in order to ensure the IBX is included in the MTA’s next Five Year Capital Plan.

Proposed Rail Line:

Brookfield pulls the listing of One New York Plaza, a 50-story office building, off the market as interest rates complicate deals. In April, it was 93% leased.

Stuy Town tenants score major win to keep apartments stabilized. A state court judge ruled in favor of residents, who argued that changes to New York’s rent law in 2019 barred the owner, the Blackstone Group, from deregulating some 6,200 apartments.

56 North Moore Street to become a new office building built on century-old bones and flanked by three-stories of terrace space. Nine floors of the office space are listed as immediately available to lease. Metro Loft may instead be eyeing a luxury condo project.

Glenwood aims for Local Law 97 compliance with carbon capture aid by installing the city’s first residential rig in the basement of the Grand Tier. The rig scrubs exhaust from two natural gas boilers, liquifying the carbon dioxide and stores it in metal tanks.

Developers filed 165 permits between mid-June and November to create nearly 12,500 homes, or 29% of the total planned for the year, even after the 421a tax break expired for project filings. Multifamily buildings nosedived 59% in the five months after the 421a tax abatement expired on June 15.

New York City REIT is changing its status from a real estate investment trust to a taxable C corporation that has 1.2 million square feet of office space but 30% is vacant.

Peter Fine, the developer, plans to build a 15-story multifamily building with 333 units at 1959 Jerome Avenue in the Bronx, replacing a garage and auto body shop. The 285,000-square-foot building will have 29,000 square feet of commercial space and a 43,000-square-foot community facility.

2022 NYC Demolition Permits

| Borough | Total Approved Permits | Total Stories for Demolition | Approved Permit Change from 2021 | |

|---|---|---|---|---|

| 1 | Brooklyn | 426 | 883 | −7.19% |

| 2 | Queens | 293 | 493 | −10.94% |

| 3 | Bronx | 192 | 378 | −11.11% |

| 4 | Staten Island | 135 | 214 | −7.53% |

| 5 | Manhattan | 112 | 390 | 13.13% |

Source Note: NYC Department of Buildings data includes demolition permits that were approved in 2022. Duplicate job filing numbers were dropped, and demolition of secondary garage and rear units were not included in the study.

Landlord fines for building emissions could hit $900 million by 2030.

Local Law 97's goal is to reduce greenhouse gas emissions across city buildings by 40% by 2030 and 80% by 2050. The limits begin taking effect next year and penalties increase strongly at the start of the following decade. More than 3,700 properties may run afoul of the law and penalties could soar above $200 million as soon as next year. Penalties are expected to worsen drastically by 2030. Owners of 13,500 properties could be fined a cumulative $900 million annually.

175 Third Street, Brooklyn, RFR filed plans in March 2022 to build a nearly 650,000-square-foot, mixed-use building with 375 apartments.

120 East 144th Street, Bronx, Beitel Group proposed a roughly 400,000-square-foot apartment building between Walton and Gerard avenues in Mott Haven. The project is expected to rise 13 stories and include 470 apartments.

832 Rutland Road, Brooklyn, Brookdale Medical Center filed plans for a 380,000-square-foot building with 322 residential units. The 12-story structure will also have commercial and community space.

563 Sackett Street, Brooklyn, BonaFide Realty filed plans for a mixed-use building that would span 360,000 square feet and include about 340 apartments.

25-02 Ninth Street, Queens, Cape Advisors filed plans for a 314,000-square-foot building in Astoria. The project is expected to have 240 residential units.

75 DeKalb Avenue, Brooklyn, RXR Realty proposed a 300,000-square-foot, mixed-use building. The project will include 375 apartments.

99 Fleet Place, Brooklyn, the Jay Group filed plans for nearly 300 residential units across more than 300,000 square feet.

3880 Ninth Avenue, Manhattan, Jay Group proposed a 300,000-square-foot, 270-unit apartment building.

315 Grand Concourse, Bronx, Mint Development filed plans for a 13-story, 250,000-square-foot building expected to have 240 apartments.

953 Dean Street, Brooklyn, Clipper Equity filed for a 240-unit, nearly 250,000-square-foot residential project. 30% of the apartments would be affordable with 8,500 square feet for commercial use.